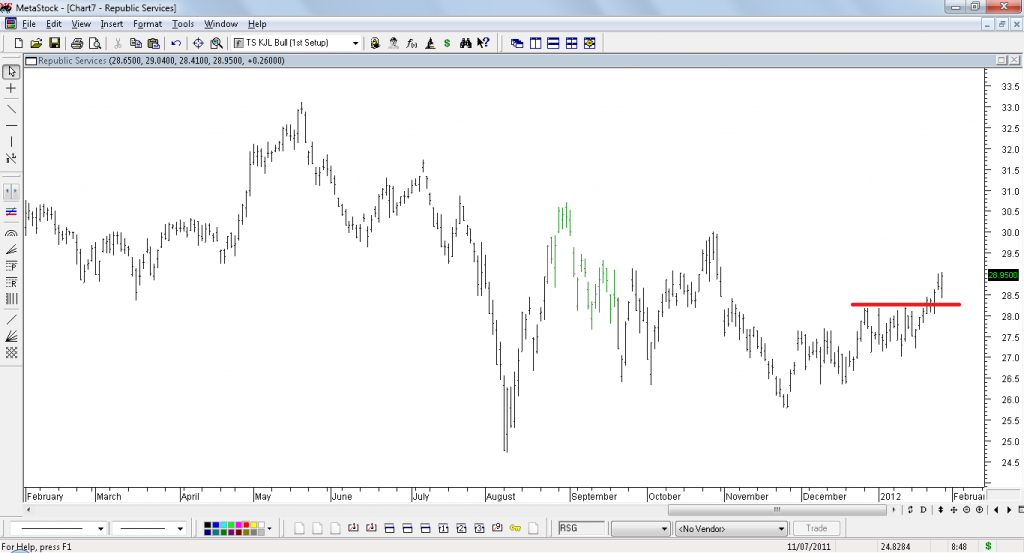

The folllowing position was stopped out

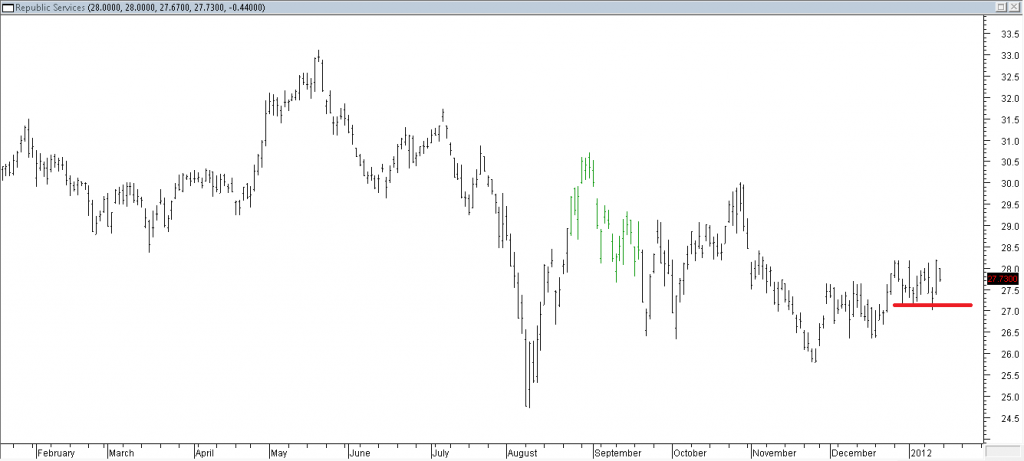

Short Position (Stopped Out)

Republic Services (US)

Had entered the following position

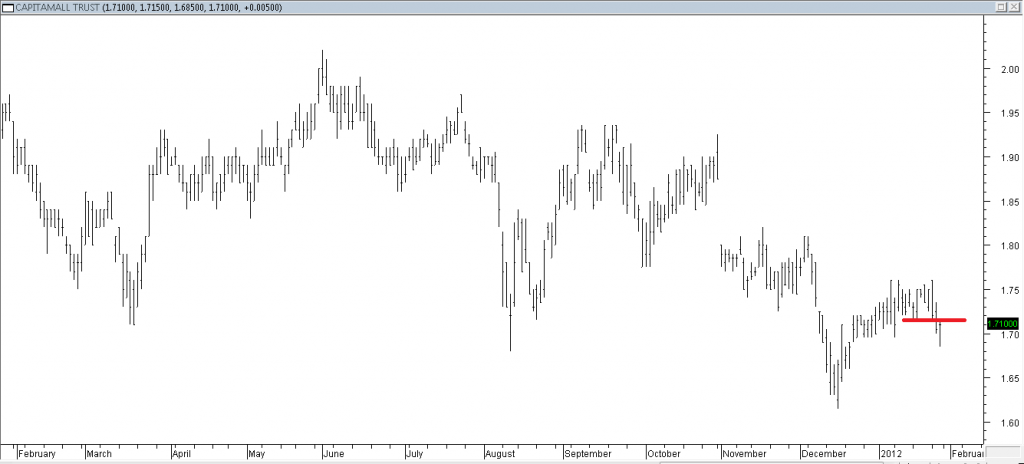

Short Positions (Initiated)

EURJPY

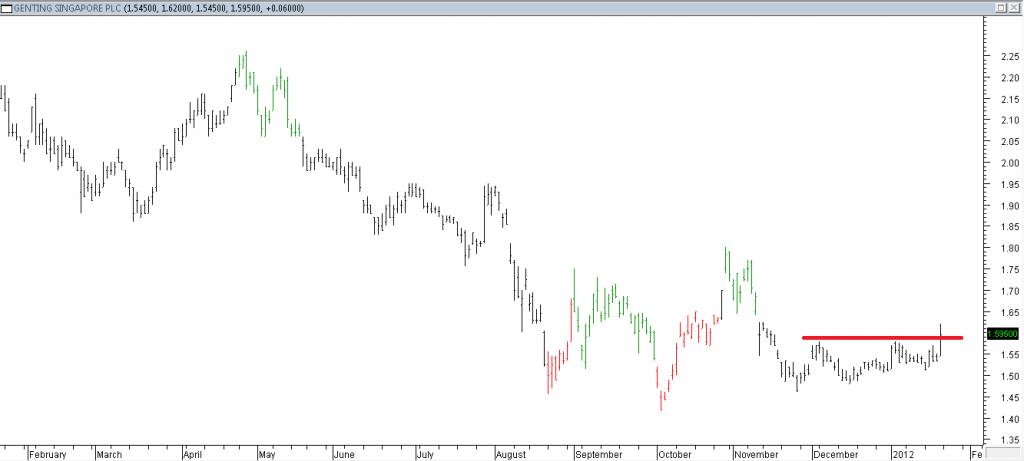

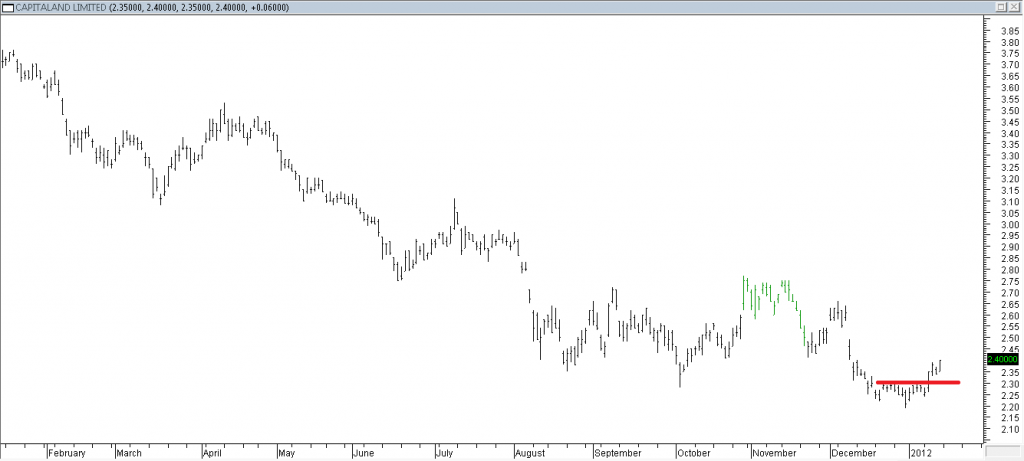

Capitamall Trust (SG)

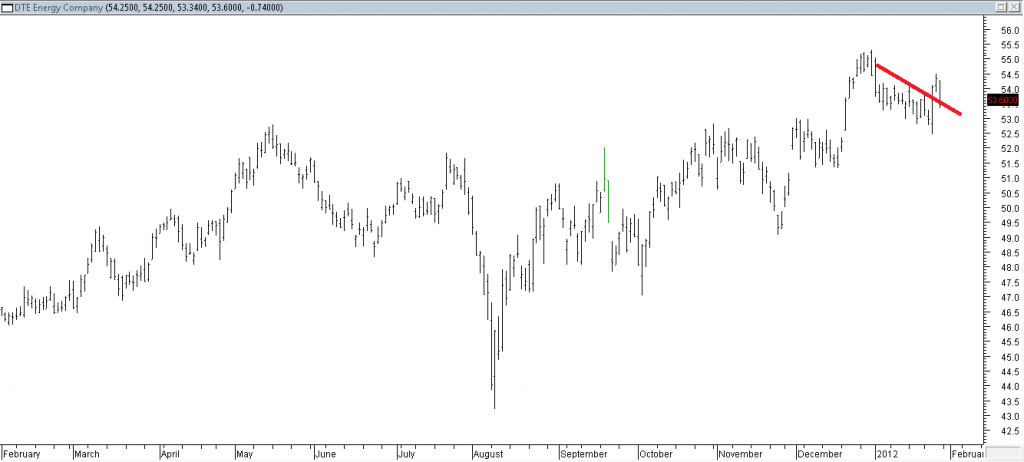

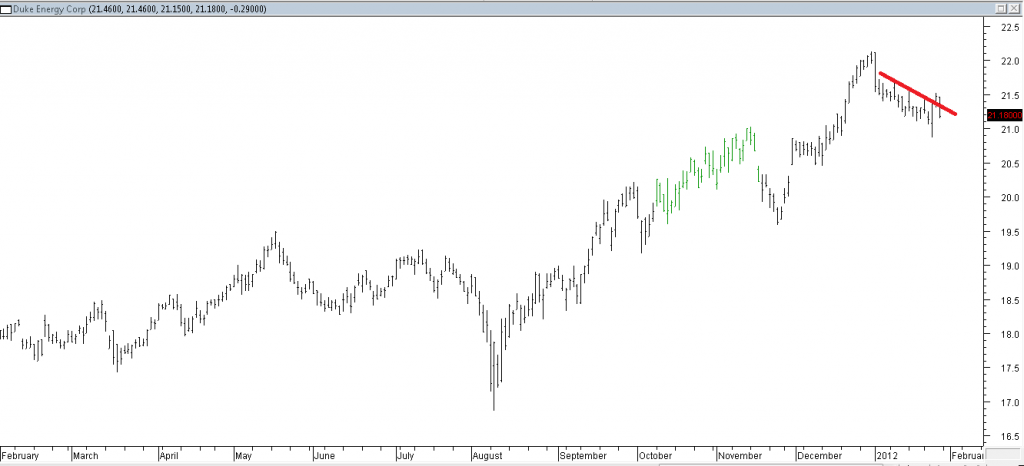

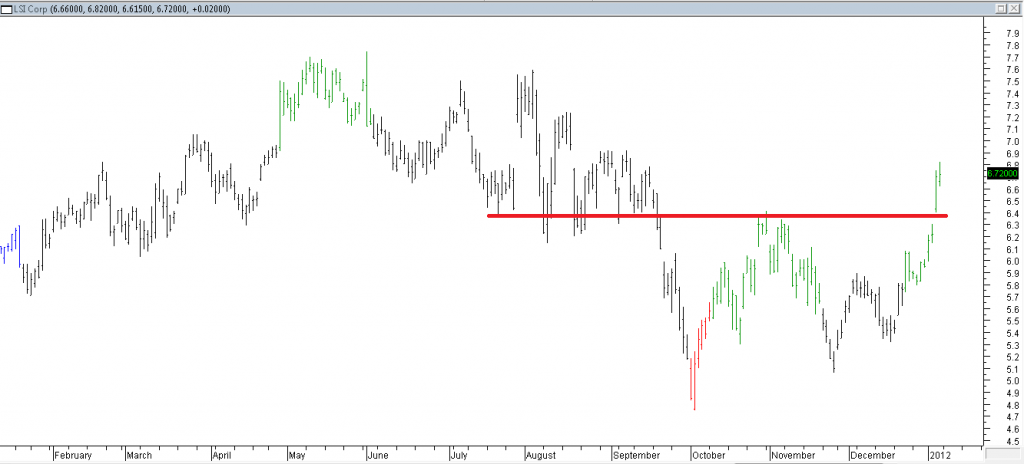

Long Positions (Initiated)

DTE Energy Company (US)

Duke Energy Corp (US)

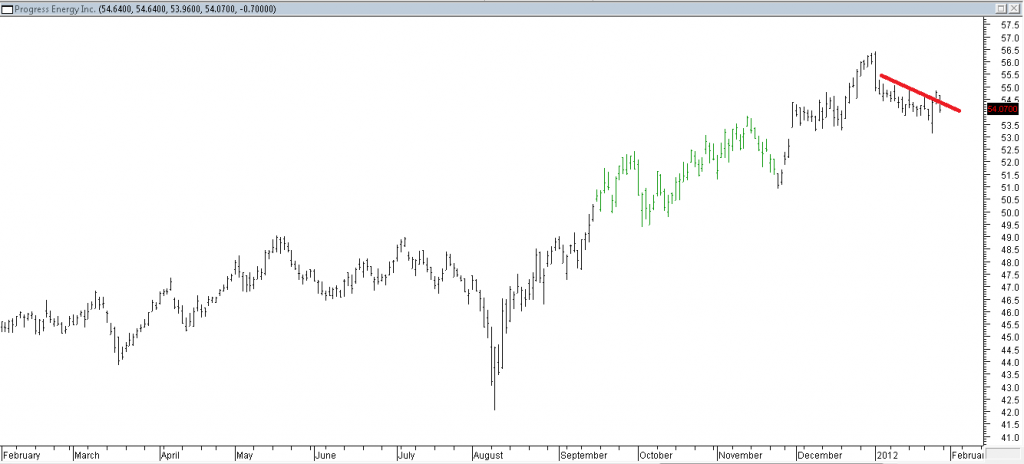

Progress Energy Inc (US)

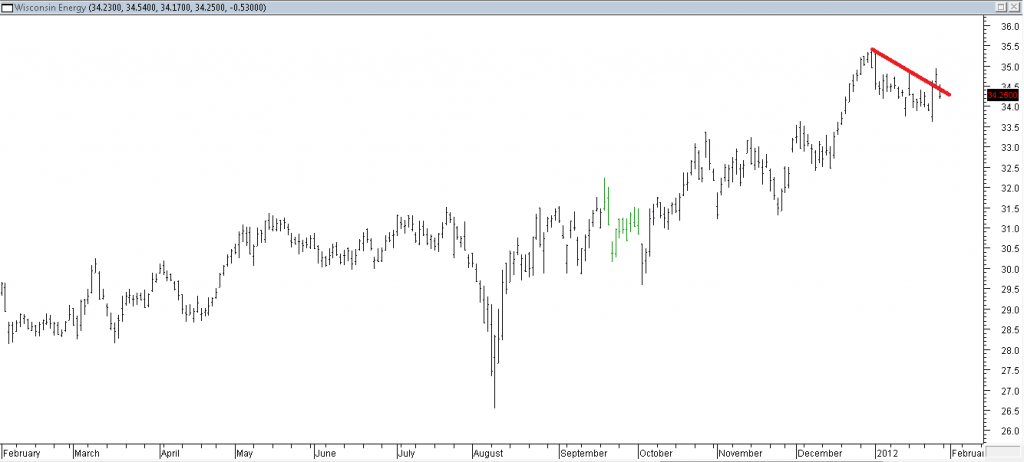

Wisconsin Energy (US)

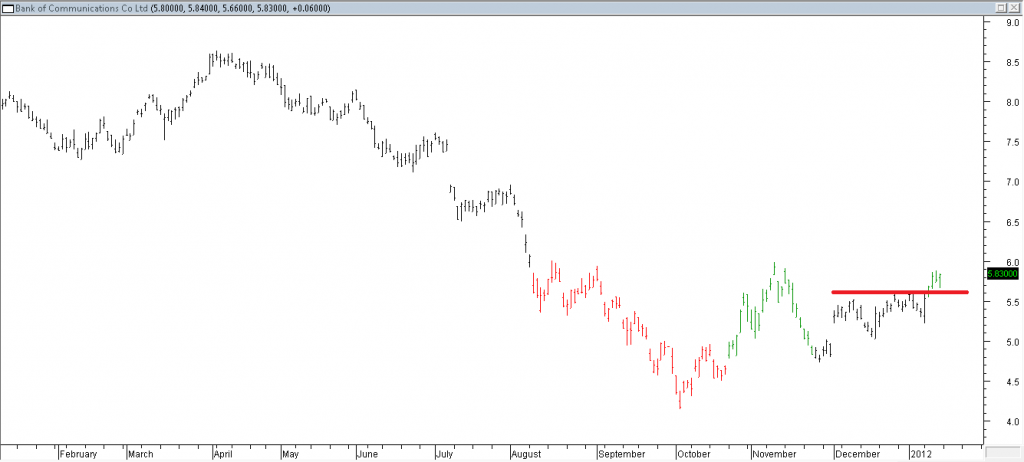

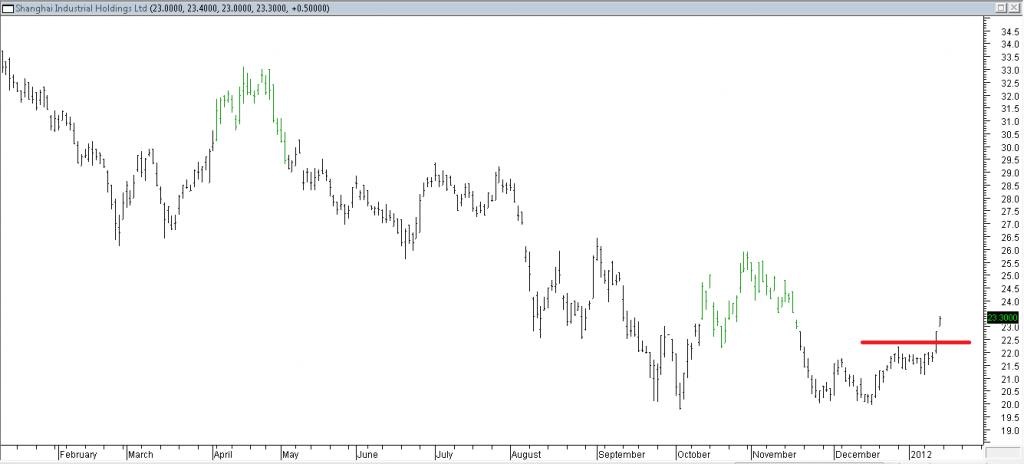

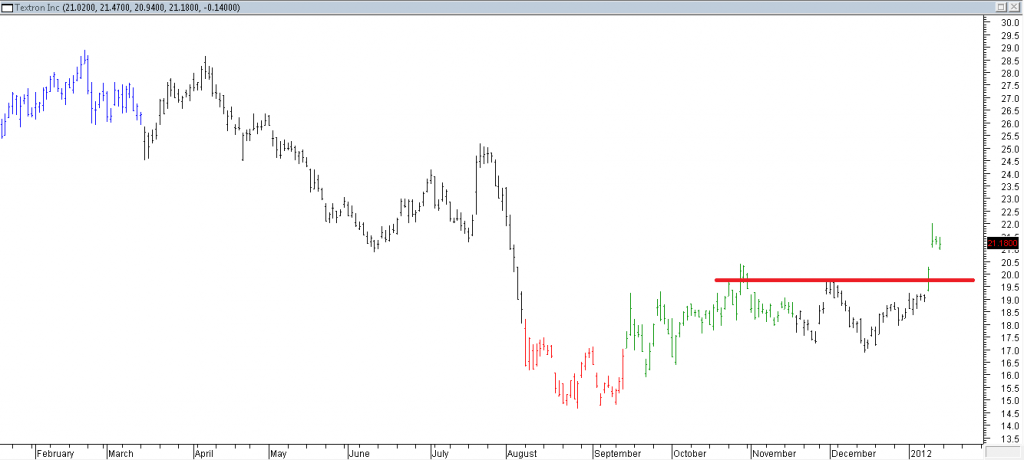

Windstream Corp short trade is still alive. This market is getting more interesting. Majority of HK and SG stocks are still downtrend driven. Some have turned up. Only US has balance of uptrend and downtrend stocks. Will this be a bullish year?

If you find my blog useful, tip me a few dollars to show your support.