Here is the update for this week

Short Positions (Initiated and Stopped Out)

GBPUSD

GBPUSD Daily Chart

The entry was made using the inside day closing price. Trade was stopped out as price moved beyond the high price of the inside day.

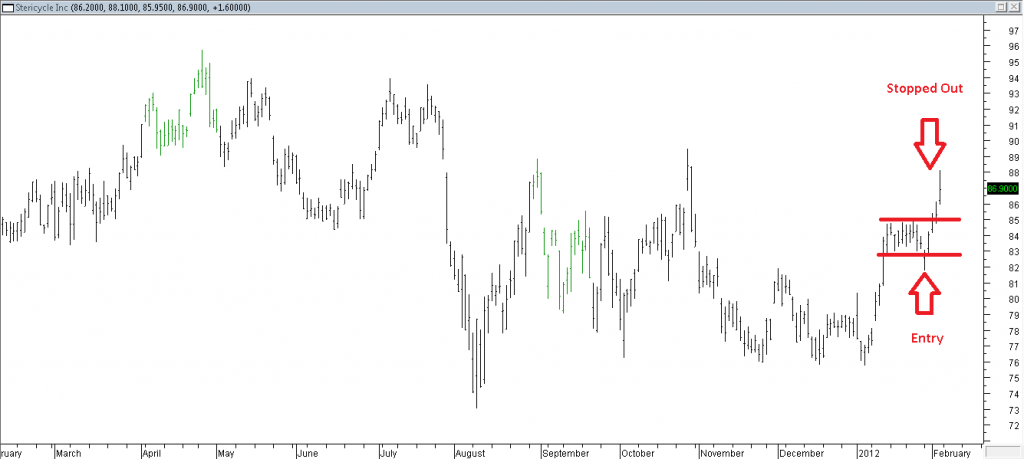

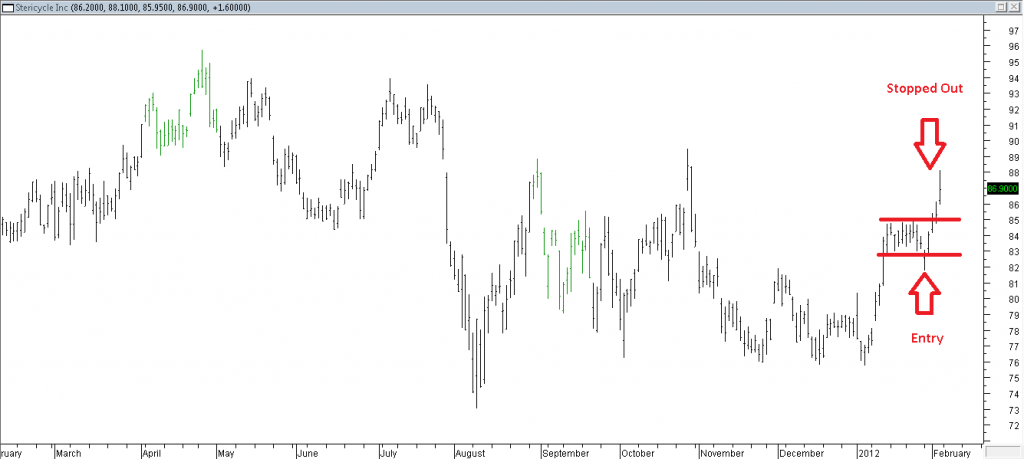

Stericycle Inc (US)

Stericycle Inc Daily Chart

This trade was stopped out due to the false break down.

Short Positions (Exited Half Position)

EURJPY

EURJPY Daily Chart

Short Positions (Initiated)

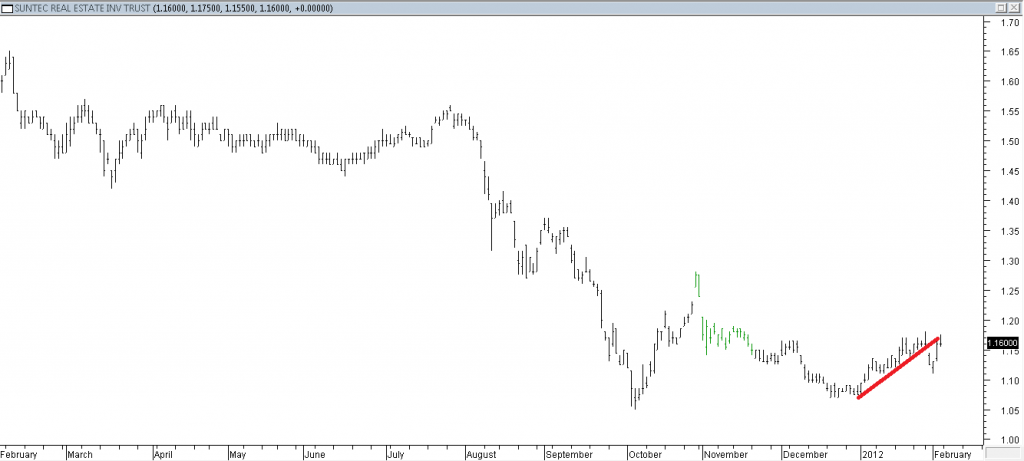

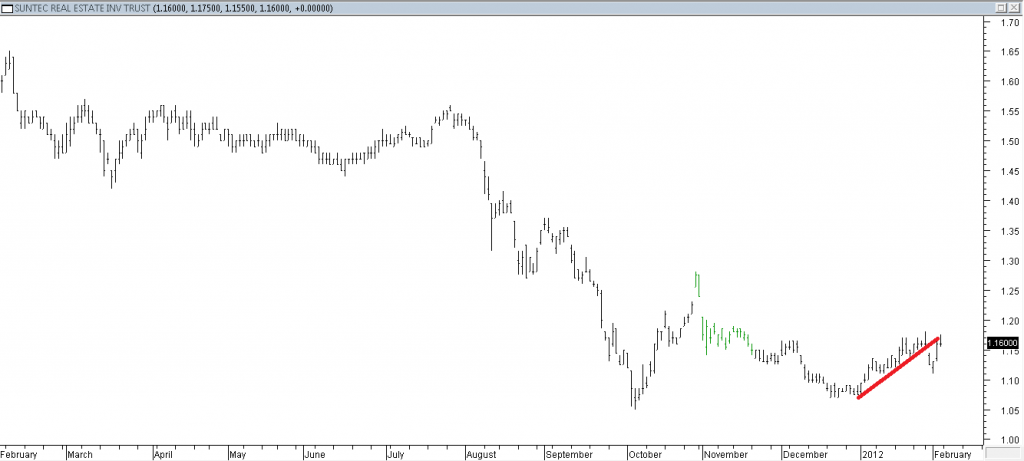

Suntec REITS (SG)

Suntec REITS Daily Chart

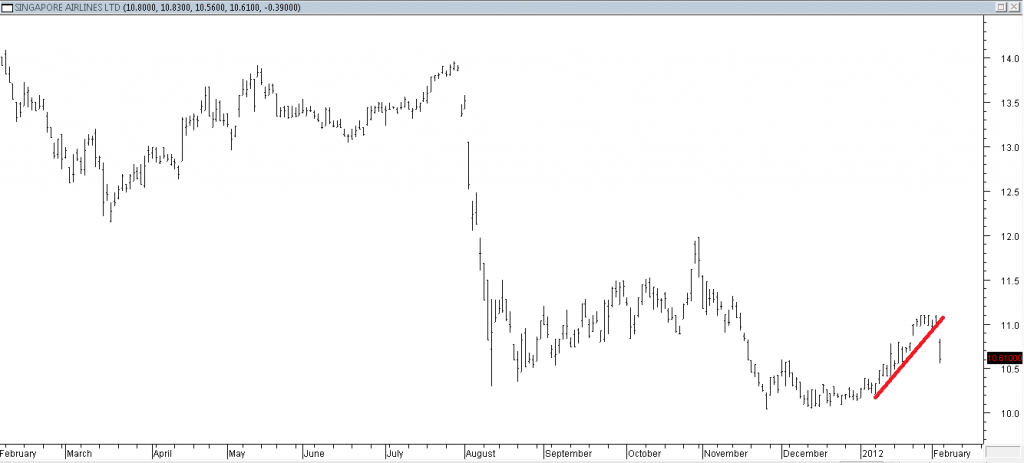

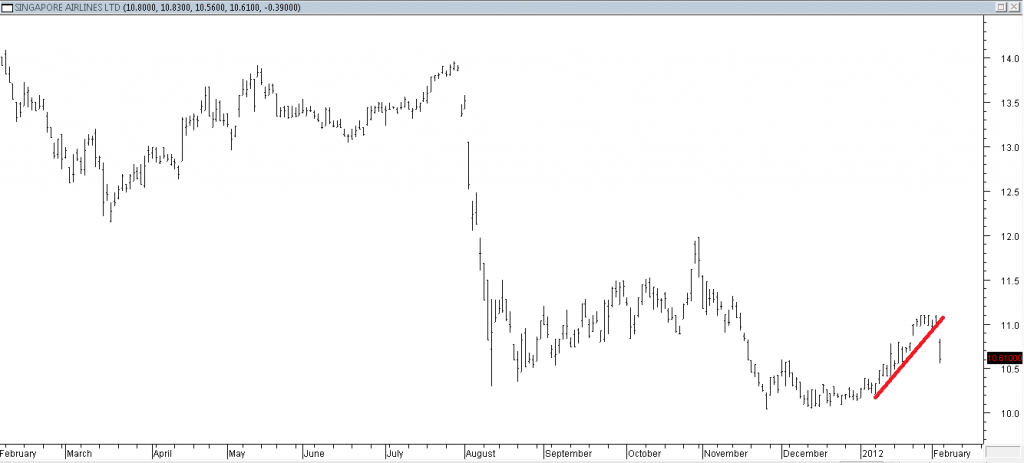

SINGAPORE AIRLINES LTD (SG)

SINGAPORE AIRLINES LTD Daily Chart

Long Positions (Initiated)

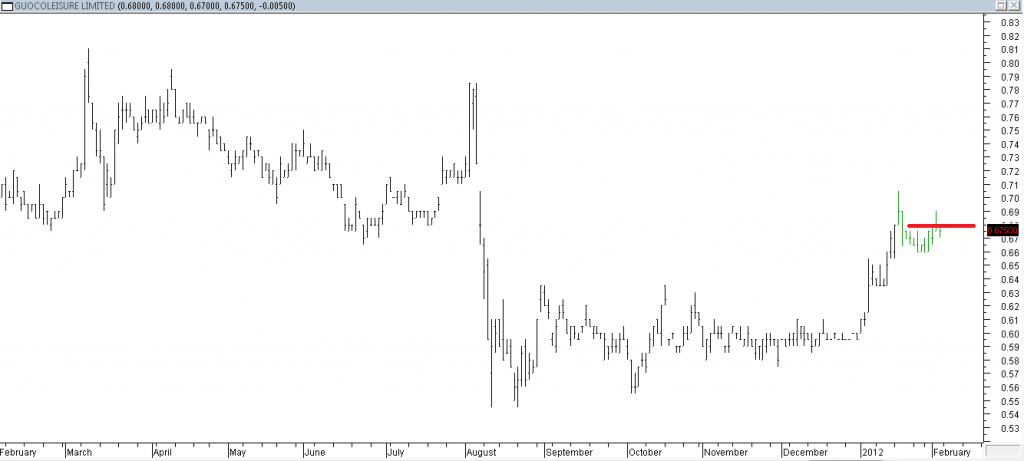

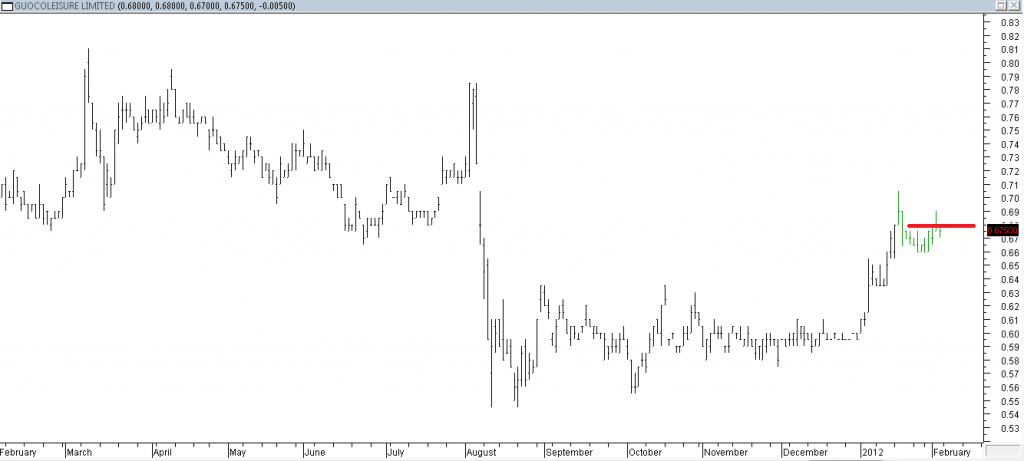

GUOCOLEISURE LIMITED (SG)

GUOCOLEISURE LIMITED Daily Chart

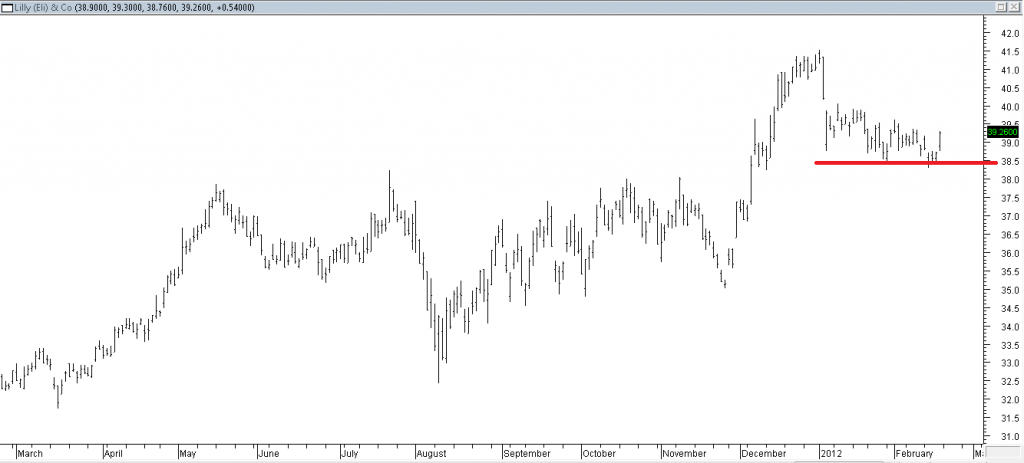

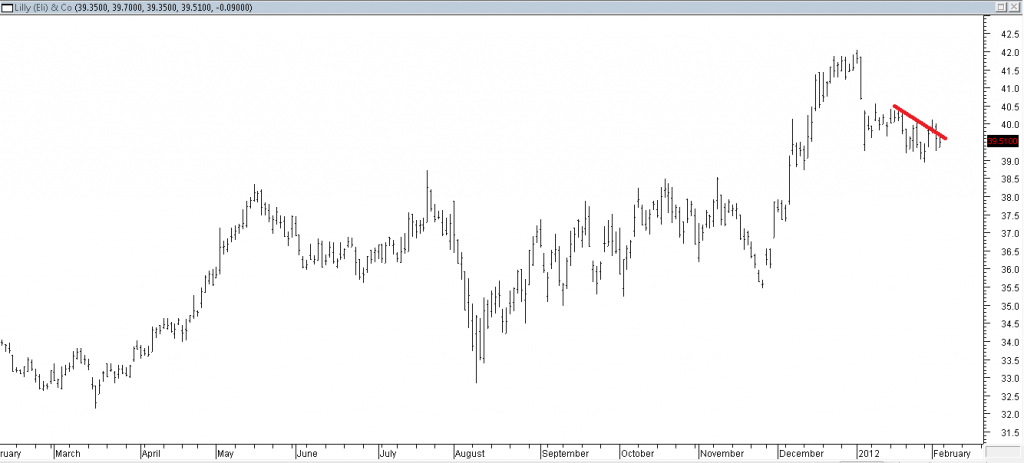

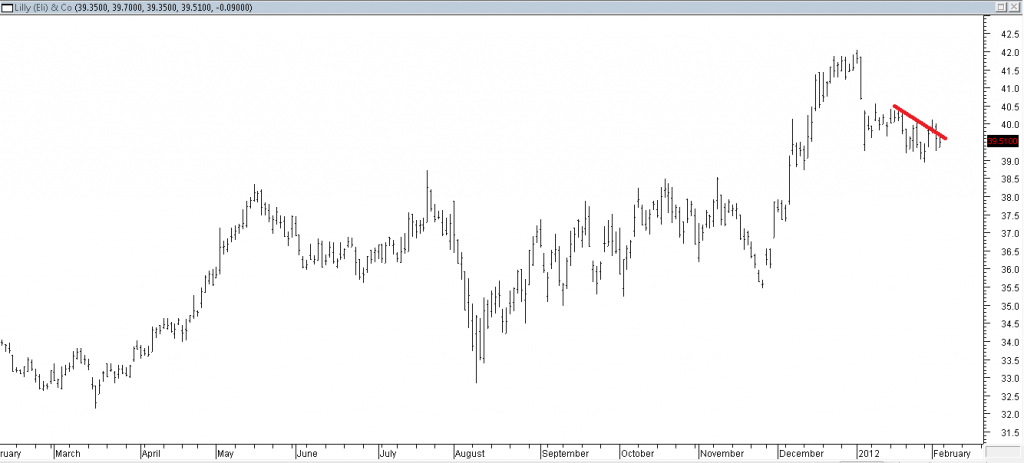

Lilly (Eli) & Co (US)

Lilly (Eli) & Co Daily Chart

USDCHF

USDCHF Daily Chart

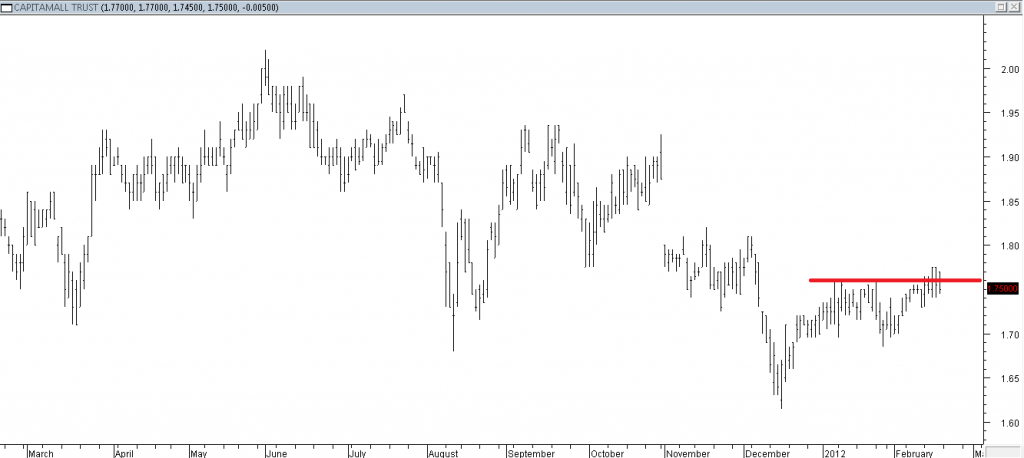

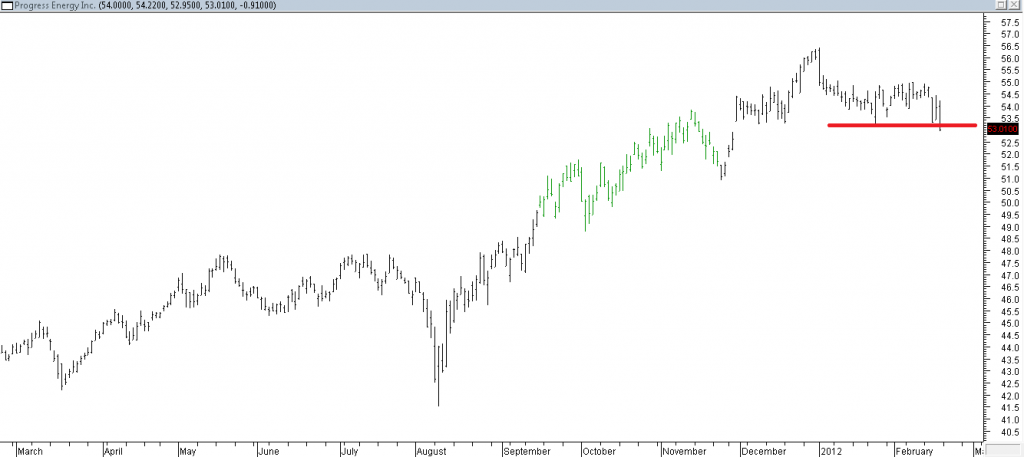

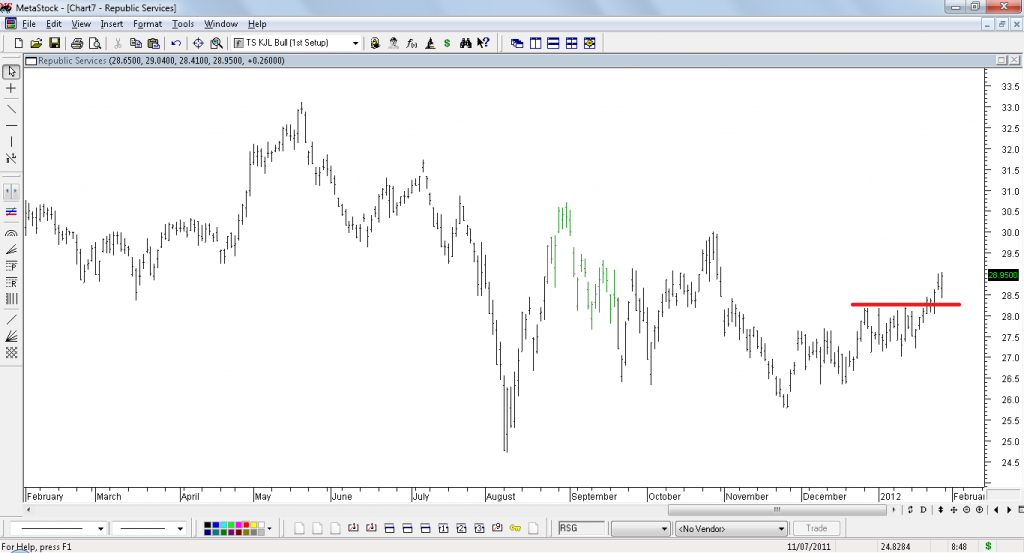

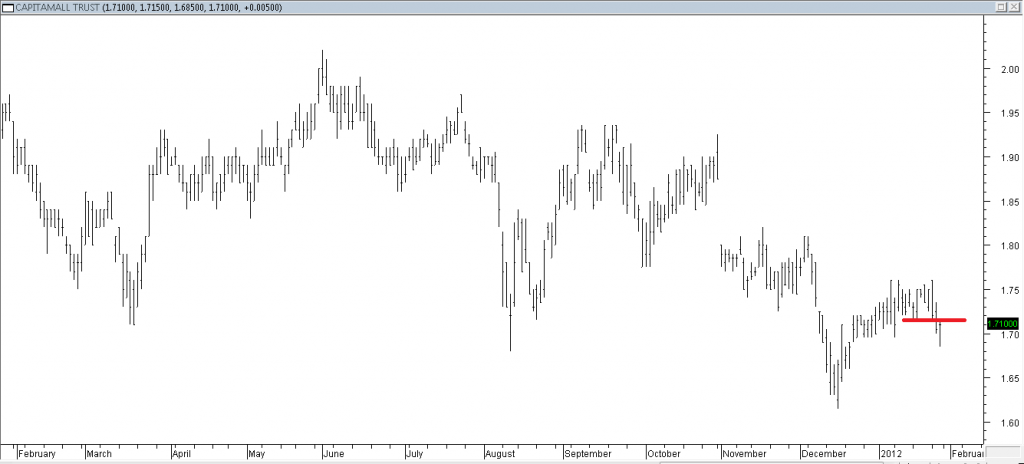

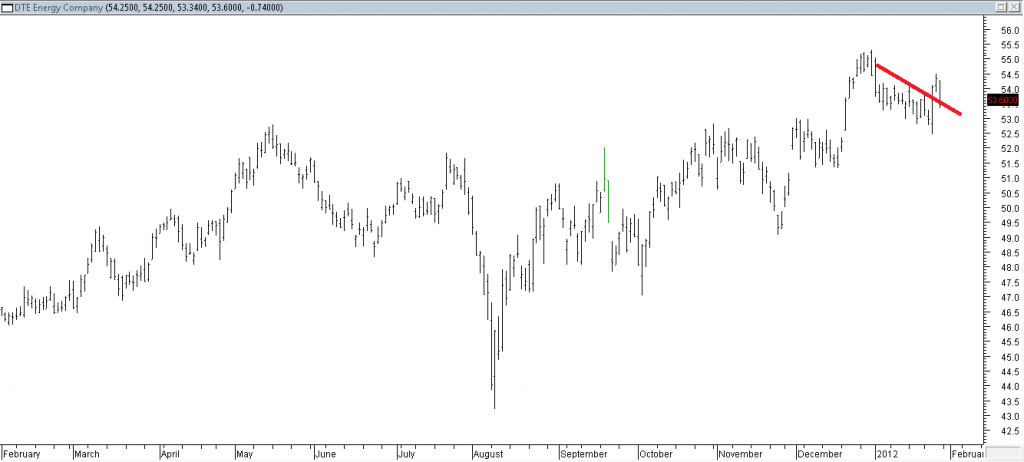

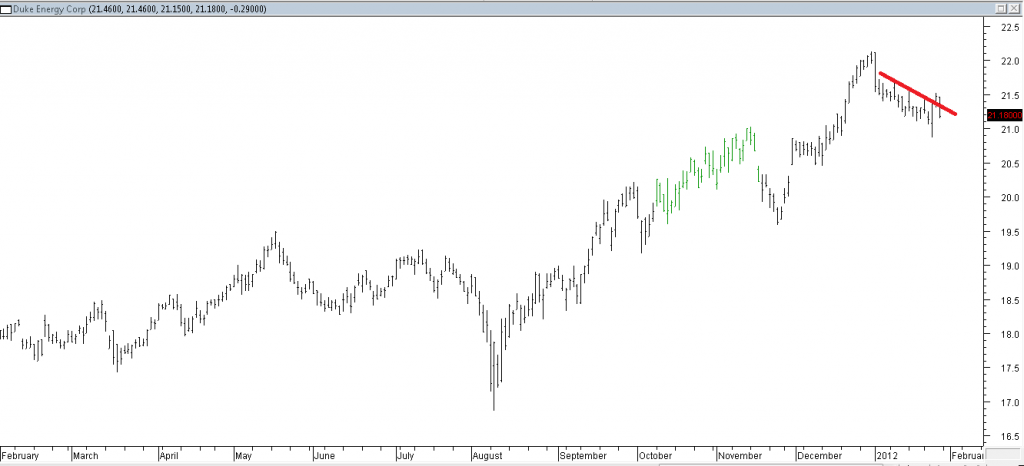

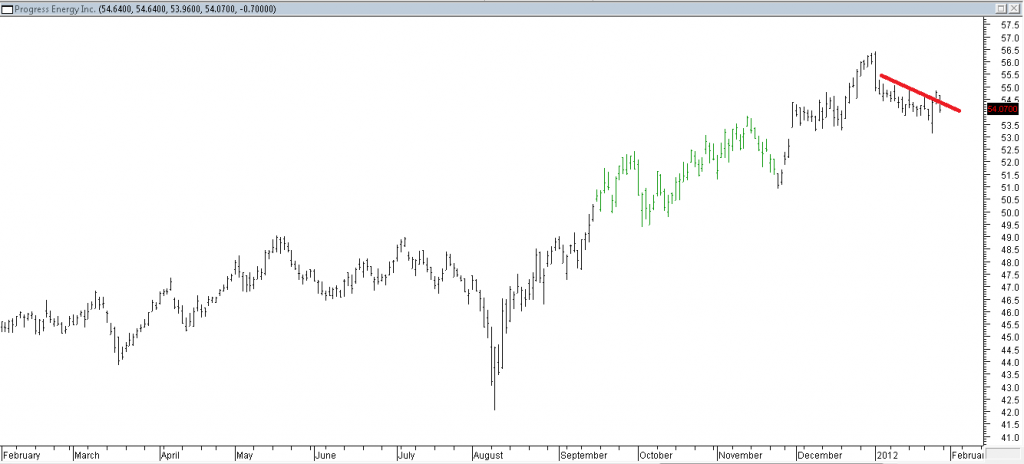

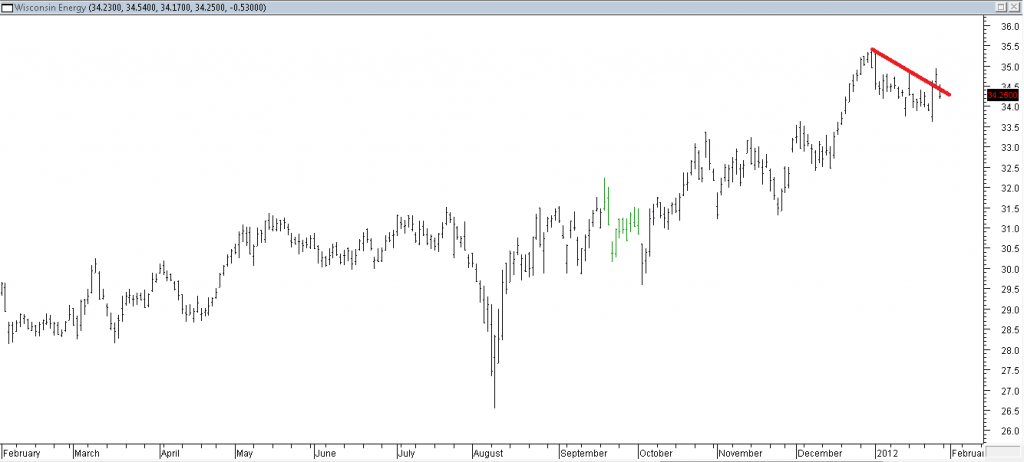

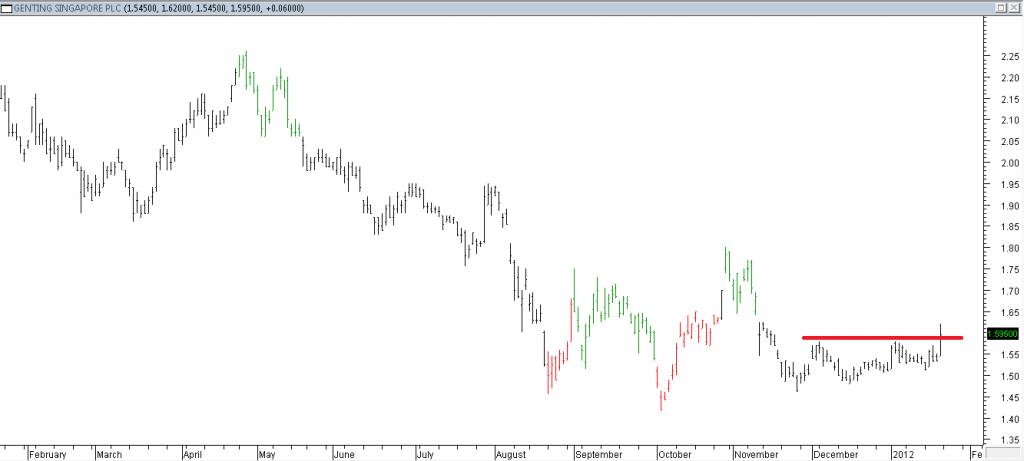

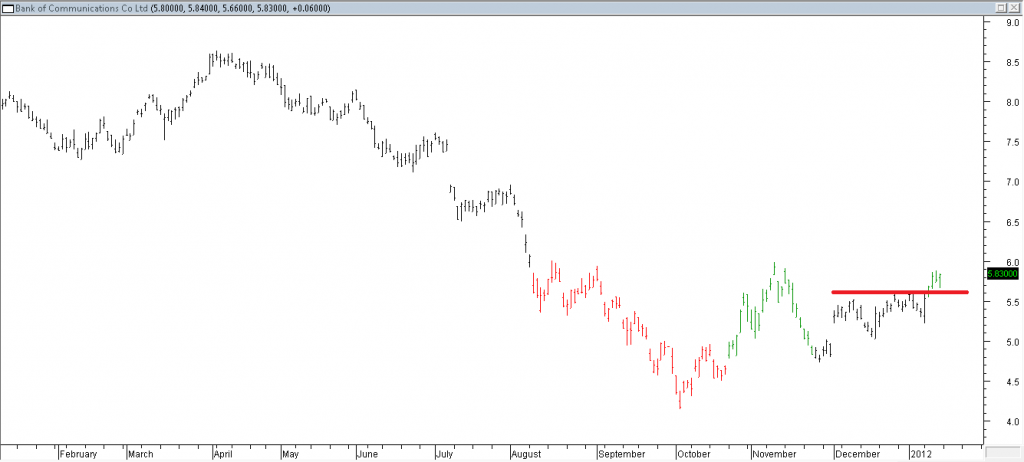

The rest of the short trades (Capitamall Trust and Windstream Corp) and long trades (DTE Energy Company, Duke Energy Corp, Progress Energy Inc and Wisconsin Energy) are still alive. How will these trades pan out?

If you find my blog useful, tip me a few dollars to show your support.